Mobile Phone Insurance

From 1.99€ / month

Broken screens shouldn’t mean broken dreams. Protect your pocket pal and save on stress.

Sign up today and get your first month free!*

* campaign is valid for monthly payment plan

Mobile Phone Insurance

From 1.99€ / month

Broken screens shouldn’t mean broken dreams. Protect your pocket pal and save on stress.

Sign up today and get your first month free!*

* campaign is valid for monthly payment plan

- FALL AND BREAKAGE DAMAGE

Dropped it? Bumped it? Don't sweat it, we've got you covered for any damage from those oops moments.

- FLUID DAMAGE

From phones taking a dive into the toilet to cats knocking over drinks onto laptops, we've seen it all. And yes, we cover all that too!

- OVERVOLTAGE & SHORT CIRCUIT

Hit by an unexpected power surge or a short circuit? No worries, we're on it!

- THEFT

Device swiped? Naw, that's rough. While we can't get your old gadget back, we sure can replace it.

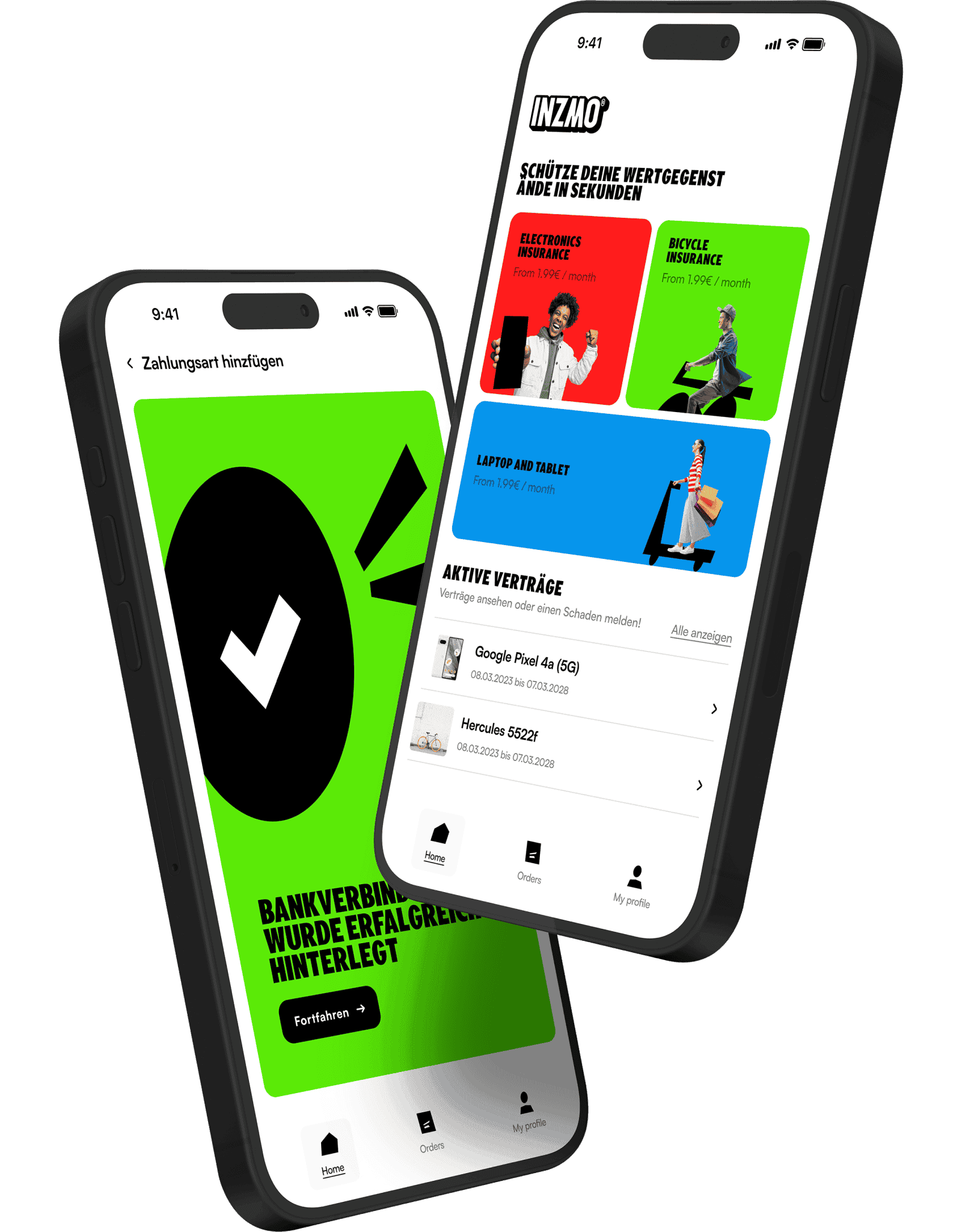

Use our cutting-edge technology for streamlined policy control, rapid claims handling, and live updates – power at your fingertips.

- Everything instant

Getting covered or submitting a claim can be done in seconds, on any device you're comfortable with.

- rapid claim resolution

Quick claim settlements through digital processes, making sure you face minimal hassle and get fast solutions when you need them most.

- 24/7 support

Powered by AI and supported by our friendly personnel, we offer an experience that's tailored to your needs around the clock.

More questions?

Our Basic Coverage covers all unforeseen damage or destruction of the device due to external causes like moisture, liquid damage, external force, short circuit, operational errors, sabotage, and vandalism.

The Premium Coverage covers also the loss of the device due to theft under certain conditions, as well as burglary.

Damages like wear and tear, improper use, cosmetic damage that doesn't affect functionality, damage by third parties responsible for repairs, or damage covered under manufacturer's warranty.

You can find an accurate list of all uninsured events in the General Insurance Conditions under Section 3.4 'Nicht versicherte Gefahren und Schäden'. If you have further questions regarding this point, our support team is always ready to assist you.

Yes, you can also insure used or refurbished phones, provided that the phone is undamaged and not older than 24 months at the time of the application. The age of the device is calculated based on the purchase date, which must be proven with a purchase receipt. Additionally, we verify the condition of the device through INZMOs mobile-application.

The contract period is 3 years. However, the minimum contract duration is 12 months. The coverage automatically ends after 3 years or in the event of a total loss or theft, without the need for a separate cancellation in writing. Additionally, after a period of 12 months, the you have the option to cancel the contract monthly with a notice period of 7 days.

Yes, there is a deductible. It depends on the purchase price of the insured device. For damages and theft, the deductible is 20% of the original device value (purchase price).

You can find detailed information about your deductible on your insurance policy and in your contract overview.

If the device is damaged or stolen, please report the damage online immediately, and no later than within 7 days after becoming aware of it.

Our claims handlers will review your claim and usually respond to you within 24 hours. We may need to contact you again for further information or documents if anything is missing (but not always!).

Once your claim has been assessed, you can have your phone repaired at a workshop of your choice. If you send us a cost estimate in advance, you'll help us assess the repair costs, and we can provide you with a binding commitment to cover the costs. Once we receive the invoice from you, you'll be reimbursed for the incurred costs. Please make sure that the serial number or IMEI number of your phone is noted on the invoice or the cost estimate so that we can process your claim as quickly as possible.

In the event of theft, report the incident not only to us but also immediately to the relevant police authority. We need a copy of the police report to assess your claim. Our claims handlers will then guide you through the next steps. Usually, you can purchase a new phone yourself, and we will reimburse you for the costs upon presentation of an invoice.

You can easily submit a claim by going to self-service.inzmo.com or by clicking "Submit a claim" on top of this page. Alternatively, you can also use the INZMO app to report the damage.

Within 14 days after purchasing the insurance, you have the option to revoke your contract. You can initiate the revocation process yourself through your contract link, which we have sent to you via email along with your contract documents, or by contacting our support team.

After the revocation period has ended, you can cancel your contract on a monthly basis with a notice period of 7 days after a minimum term of one year. The cancellation date is determined by the insurance start date. Please direct your cancellation request to our support team.

You can reach our support team via chat or by sending an email to info@inzmo.com.

150,000+ customers served (and counting)

As if you need more reasons to join the revolution. Don´t take our word for it. Take theirs.

UPGRADE YOUR INSURANCE GAME

Use our app across all devices to manage your coverage and claims in a few clicks.