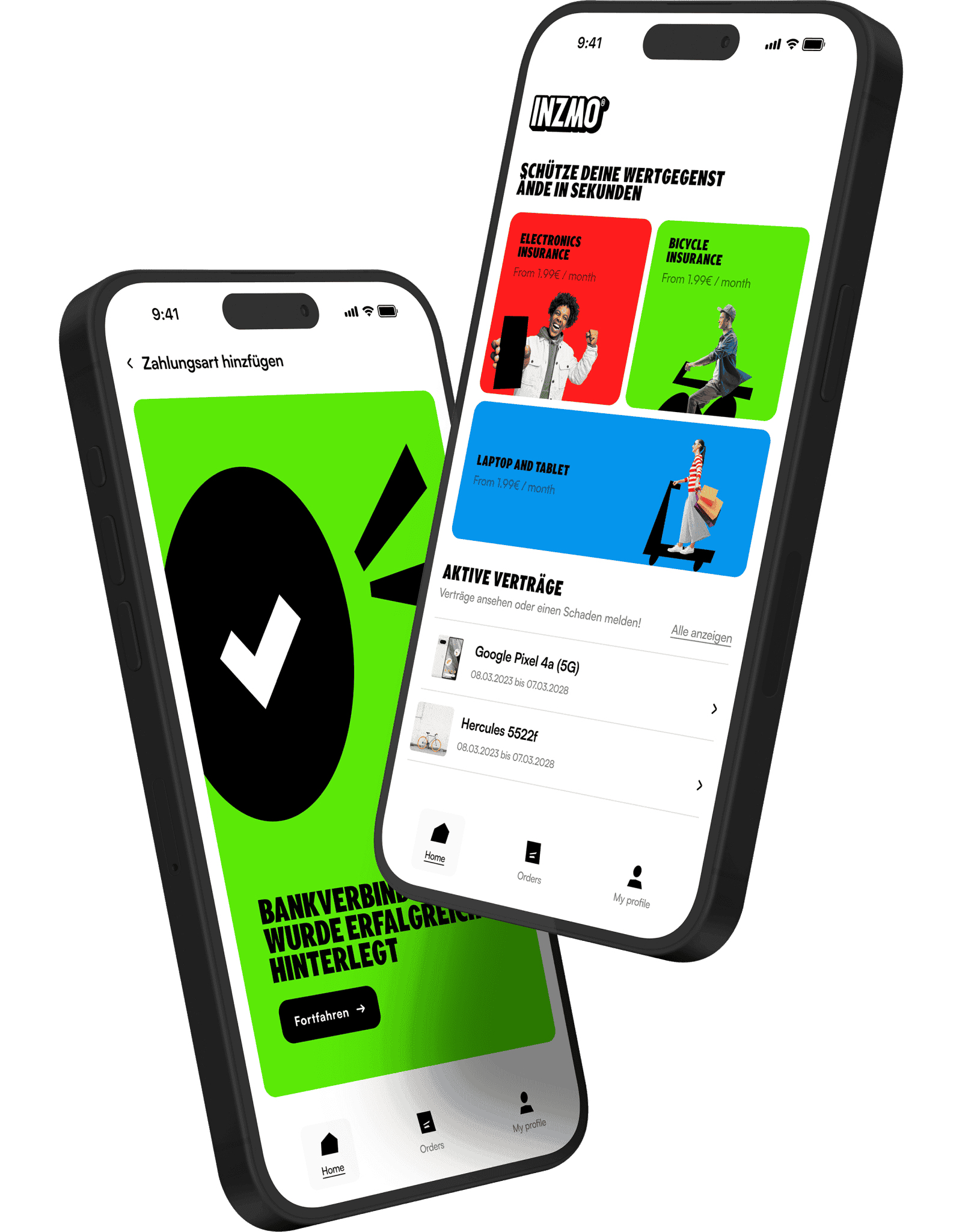

At INZMO, we insure the important things you can’t live without from gadgets, bikes and rental deposits!

A++ experienceMy first insurance claim, a broken display. The service was great, with nice staff, fast online processing, and prompt payment for the repair. This is exactly how I imagine good mobile insurance should be - simply top-notch.

150,000+ customers served (and counting)

As if you need more reasons to join the revolution.

Don't take our word for it. Take theirs.

We’re revolutionaries (but in a good way)

INZMO is similar to an insurance company, except that people actually like us.

Since 2017, we’ve been bringing innovation to our customers to make insurance easy to understand and accessible for everyone.

- Now now now

You can get covered fast; you can make a claim fast; we’ll keep this short so you can also read it fast

- FAST & Simple CLAIMS

Sure, filing claims is fast, but so is resolving them; our digital–based process means minimal hassles too

- 24/7 SUPPORT

Between our team and AI, you’re well supported 365 days a year; make that 366 days if it’s a Leap Year

UPGRADE YOUR INSURANCE GAME

Use our app across all devices to manage your coverage and claims in a few taps.